European stock markets dipped on Tuesday following U.S. President Donald Trump's criticism of the Federal Reserve chair that triggered a selloff of U.S. assets, increasing pressure on Treasuries while gold reached a new all-time high. Trump intensified his reproach of Fed Chair Jerome Powell for failing to lower interest rates, labelling him a "major loser" in a social media post on Monday, which sparked worries about the president's sway over the central bank.

On Monday, Wall Street indexes fell by approximately 2.4 per cent, and the dollar reached its lowest point in three years. U.S. Treasury yields increased as investors feared the government might attempt to replace Powell with someone inclined to lower rates.

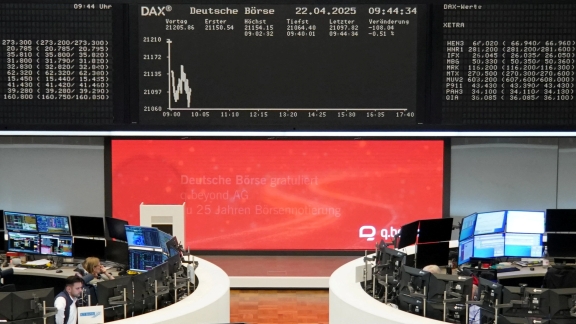

Last week, Trump stated his belief that Powell would resign if asked by him, despite Powell insisting he would not. It remains uncertain if Trump possesses the power to terminate Powell, although lawsuits concerning unrelated dismissals by Trump are being monitored as potential substitutes. Trump's erratic policymaking and inconsistent statements regarding U.S. tariffs, which traders worry could lead to significant disruptions in global trade, have already unsettled Investor trust. The selloff was not as intense during Asian trading on Tuesday. European stock markets appeared to stabilise, although the markets were varied, with the STOXX 600 falling 0.4 per cent and Germany's DAX declining 0.2 per cent at 0909 GMT. The FTSE 100 increased by 0.2 per cent.

Trump Criticism Jolts Global Markets

Trump Criticism Jolts Global Markets

The MSCI World Equity index decreased by under 0.1 per cent for the day (MIWD00000PUS) opening. "The market is quite anxious, so any hint of negativity or concern is simply amplified," stated Fiona Cincotta, senior market analyst at City Index.

"Investor anxiety is quite high, mainly due to the trade war, and it's further intensified by the clash between Trump and Powell," she added.

ALSO READ: Tripura Transport Department Goes Cashless, Sets Revenue Record With Rs 155 Crore Collection

The U.S. dollar index on Monday stood at approximately 98.369, stabilising after reaching its lowest point since March 2022. The euro stood slightly lower at $1.1502. "The autonomy of the Federal Reserve is fundamental to the dollar's trustworthiness," remarked Quasar Elizundia, a research strategist at broker Pepperstone.

"The dollar's role as the supreme safe-haven asset can no longer be assumed; it is currently under significant challenge," stated Elizundia. U.S. Treasury yields, which have increased in the past weeks, showed indications of stabilising in early trading on Monday, with the U.S. 10-year yield at 4.4125 per cent.

The dollar's decline, combined with the appetite for safe-haven assets, propelled gold to a record high of $3,500.05 before settling at approximately $3,455.43, still an increase for the day overall. Traders will keep an eye on the earnings reports throughout the week as 27 per cent of the S&P 500 is set to disclose results. Tesla is all set to report its earnings later on Tuesday, following a nearly 6 per cent drop on Monday amid news of production delays. Meanwhile, Google’s parent company, Alphabet, will announce its earnings on Thursday.