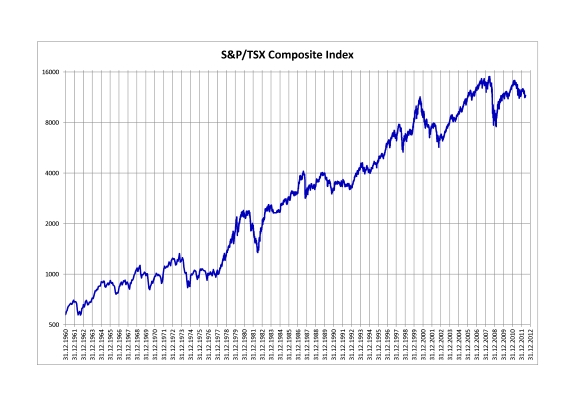

TORONTO: Canada's primary stock index is expected to mostly retain its latest gains for the remainder of 2025 but may face the possibility of another correction as the national economy exhibits indicators of a slowdown linked to U.S. tariffs, according to a Reuters survey. The S&P/TSX Composite index has surged almost 16 per cent from its lowest closing point in April, achieving a record closing high of 26,073.13 on Monday. Since the beginning of the year, the index has risen by 5.4 per cent, surpassing significant U.S. indexes like the S&P 500. It has benefited from a considerable emphasis on metal mining stocks as safe-haven demand drove gold prices to unprecedented levels. "We continue to think that the worst uncertainty is past us, but the effects of tariffs are starting to emerge in the Canadian economy," stated Angelo Kourkafas, a senior global investment strategist at Edward Jones.

TSX faces pressure from tariffs

TSX faces pressure from tariffs

Canada exports roughly 75 per cent of its goods to the United States, with steel, aluminium, and automobiles facing significant U.S. tariffs, while the unemployment rate in Canada reached 6.9 per cent in April, the highest since November. The median forecast from 21 equity strategists and portfolio managers in the poll conducted from May 15-27 indicated that the S&P/TSX Composite index would rise 0.7 per cent to 26,250 by the end of the year, which is a bit below the 26,500 target projected in a February survey. "While companies manage the effects of tariffs and adjust their inventory strategies, along with a tendency to postpone capital investments, profit margins are expected to come under strain," stated Victor Kuntzevitsky, a portfolio manager at Stonehaven, Wellington-Altus Private Counsel. Of the 13 analysts who responded to a different question, seven indicated that corporate earnings would decline in 2025 compared to 2024, whereas eight out of 13 predicted that a correction was probable or very probable in the next three months.

In April, a correction, defined as a 10 per cent decline or more from the peak, was confirmed before the market's recovery. "We are concentrating more on dividend-paying stocks as they will safeguard a portfolio more effectively during a market downturn," stated Ben Jang, a portfolio manager at Nicola Wealth. "Gradually, decreasing interest rates are anticipated to lead to withdrawals from money market instruments." The Bank of Canada has reduced its key interest rate by 2-1/4 percentage points since last June, bringing it down to 2.75 per cent, to bolster the economy. Analysts suggest that reduced borrowing expenses and the possibility of trade agreements might lead the market to rise again. The index was anticipated to hit 27,750 by the close of next year, representing a rise of 6.4 per cent. "Once trade becomes clearer and reduced interest rates begin impacting the economy in 2026, we anticipate a resurgence in earnings," Kourkafas of Edward Jones stated.